There's a change happening in just how younger generations speak about money. For Gen Z, the days of silent budgeting where funds were taken care of inconspicuously behind closed doors are promptly fading. In its area, a bold, unapologetic fad has actually arised: loud budgeting.

Exactly what is loud budgeting? It's a motion that embraces financial openness. It's concerning being vocal with your friends when you can't afford an expensive dinner out. It's concerning selecting a much more inexpensive getaway and happily discussing why. It's budgeting with self-confidence and, most importantly, without pity. For Gen Z, loud budgeting isn't just a technique, it's a form of self-expression and empowerment.

Why Loud Budgeting Resonates with Gen Z

Gen Z has actually grown up in the darkness of significant monetary occasions from the 2008 recession to the pandemic economic situation. A number of them saw their moms and dads deal with debt, housing instability, or job instability. Consequently, this generation is hyper-aware of the importance of monetary stability, but they're rewording the rulebook in just how they approach it.

They're not afraid to talk about their money goals. Whether they're paying off trainee financings, saving for their first apartment, or contributing to a money market account, Gen Z thinks that financial conversations should be truthful and normalized. By turning budgeting into something you state out loud instead of hiding, they're getting rid of the stigma that so commonly includes individual financing discussions.

This type of openness also creates accountability. When you inform your friends, I'm not investing added this month due to the fact that I'm saving for an auto, it not just strengthens your monetary goal yet aids others appreciate your boundaries and perhaps even motivates them to embrace similar behaviors.

Social media site and the Power of Financial Storytelling

Platforms like TikTok and Instagram have played a huge duty in intensifying this pattern. What might have once been taken into consideration personal, like monthly costs breakdowns or total assets landmarks, is currently cooperated brief video clips, monetary vlogs, and candid inscriptions. These messages aren't showing off wealth; they're revealing what real finance looks like.

Gen Z isn't just displaying what they can buy. They're talking about how much they conserve, how they avoid debt, and what their financial obstacles are. There's something deeply relatable and motivating concerning enjoying someone your age describe why they're dish prepping as opposed to purchasing takeout or how they're utilizing personal loans to consolidate charge card financial obligation and reduce economic anxiety.

Loud budgeting, in this way, becomes a form of community-building. It says: You're not the only one. I'm figuring this out also. Which cumulative openness is one of one of the most empowering things about the motion.

The Influence on Spending and Saving Habits

Loud budgeting isn't just talk, it's transforming habits. Gen Z is adopting creative methods to make budgeting work for them. They're challenging old norms concerning maintaining looks or avoiding looking damaged. Rather, they're redefining what financial stamina resembles.

That might imply honestly picking a side rush over happy hour. Or happily saying no to a stylish tech purchase due to the fact that there's a larger goal imminent. It's everything about lining up everyday investing with long-term concerns and being vocal regarding it.

Lots of are additionally seeking out devices and resources that sustain their objectives, from budgeting source applications to adaptable financial savings choices. Some are diving right into the globe of electronic envelopes or picking to automate transfers into a money market account where their cost savings can grow while still staying available.

The result? A generation that's ending up being more financially literate, intentional, and fearless about managing their money on their own terms.

How Loud Budgeting Shapes Conversations Around Debt

Among one of the most effective elements of this pattern is how it's changing the story around financial debt. In previous generations, bring financial obligation, especially consumer financial obligation, was usually a resource of shame. It was kept quiet, surprise below a sleek exterior.

Gen Z, nevertheless, is reframing financial obligation as something to be recognized, handled, and also talked about openly. They're sharing their trainee lending payback trips, discussing the benefits and drawbacks of using bank card, and explaining exactly how they're leveraging personal loans for critical reasons, not out of desperation.

This type of honesty develops area for real conversations. It motivates smarter decision-making and reduces the anxiousness and isolation that typically include financial battles.

It likewise highlights the significance of having accessibility to financial institutions that sustain these progressing requirements. While Gen Z might not comply with the very same economic path as their moms and dads, they still seek stability, access, and services that line up with their goals.

Loud Budgeting Meets Modern Banking Expectations

To sustain their luxurious budgeting lifestyles, Gen Z is trying to find organizations that supply greater than just inspecting accounts. They desire education and learning, empowerment, and practical tools that fit their mobile-first, always-on world.

This consists of flexible monetary items, electronic benefit, and approachable suggestions. Provider like lending institution business services are progressively relevant, especially as numerous in Gen Z check out entrepreneurship or side rushes as a path to financial liberty.

These people are not waiting till their 30s to develop monetary independence. They're beginning now track their costs, establishing objectives, and finding value in establishments that listen and adjust to their worths. Whether they're conserving, borrowing, or launching a small company, they intend to feel like partners in their monetary trip, not just account numbers.

The Future of Financial Empowerment Is Loud

Loud budgeting may have started as an individual finance pattern, however it's quickly becoming a social shift. It's about breaking down obstacles, testing out-of-date cash taboos, and cultivating healthier, a lot more educated partnerships with money.

Gen Z is leading the cost not by making believe to have all of it identified, however by being brave sufficient to discuss the journey. They're establishing an effective example for what it resembles to prioritize monetary health without apology.

And as this activity grows, so does the chance for every person, regardless of age, to reassess how we budget plan, invest, and save. Since the fact is, monetary quality does not have to be quiet. Occasionally, the most accountable point we can do is claim it aloud.

Adhere to the blog site for more insights on economic empowerment, and check back frequently for updates on just how today's cash practices are forming tomorrow's future.

Devin Ratray Then & Now!

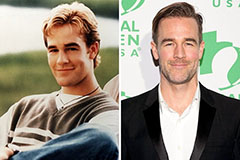

Devin Ratray Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!